Apartment Construction: How To Do The Quality Check?

Welcome to our comprehensive guide to ensuring quality construction. Whether you are an experienced contractor or new to the construction industry, maintaining high standards is paramount to the success and longevity of any room.

Read More

How To Find Apartments Near Public Transportation?

Welcome to our comprehensive guide to ensuring quality construction. Whether you are an experienced contractor or new to the construction industry, maintaining high standards is paramount to the success and longevity of any room.

Read More

10 Apartment Hunting Tips For New Home Buyers

Welcome to our comprehensive guide to ensuring quality construction. Whether you are an experienced contractor or new to the construction industry, maintaining high standards is paramount to the success and longevity of any room.

Read More

Innovative Warehouse Design Trends: Revolutionizing Storage Efficiency

The landscape of commercial properties is undergoing a transformative shift, driven by evolving consumer preferences, technological advancements, and sustainability imperatives.

Read More

Apartment Construction: How To Do The Quality Check?

Welcome to our comprehensive guide to ensuring quality construction. Whether you are an experienced contractor or new to the construction industry, maintaining high standards is paramount to the success and longevity of any room.

Read More

The Future of Commercial Properties : A look into the future

The landscape of commercial properties is undergoing a transformative shift, driven by evolving consumer preferences, technological advancements, and sustainability imperatives.

Read More

Unlocking the Potential: Your Comprehensive Guide to Rental Properties in Pune

From IoT sensors to automation solutions and AI-powered analytics, these advancements are revolutionizing the warehouse sector and shaping its future.

Read More

Best Warehousing Companies in Pune (2024)

Pune, a bustling metropolis in India, is not only known for its vibrant culture and thriving IT industry but also for its rapidly evolving warehouse sector.

Read More

Optimizing Industrial Sheds for Efficiency

From IoT sensors to automation solutions and AI-powered analytics, these advancements are revolutionizing the warehouse sector and shaping its future.

Read More

Revolutionizing Warehouse Real Estate: Exploring Technology Trends Shaping the Future

The warehouse real estate landscape is undergoing a profound transformation, driven by the integration of cutting edge technologies.

Read More

Elevating Industrial Experiences: Emerging Trends in Industrial Shed Amenities by Jaywant Group

Investing in farmland is a time-tested strategy that offers a myriad of benefits, from financial stability to environmental conservation.

Read More

Optimizing Operations: The Strategic Advantages of Warehouse Leasing Near Pune

Investing in farmland is a time-tested strategy that offers a myriad of benefits, from financial stability to environmental conservation.

Read More

Unlocking Opportunities: Why Invest in Commercial Properties in Pune?

Investing in farmland is a time-tested strategy that offers a myriad of benefits, from financial stability to environmental conservation.

Read More

Exploring the Lucrative Benefits of Farmland Ownership with Jaywant Group

Investing in farmland is a time-tested strategy that offers a myriad of benefits, from financial stability to environmental conservation.

Read More

Navigating India's Real Estate Landscape: 2023's Second Half Trends and Investment Opportunities with Jaywant Group

When it comes to industrial investments, savvy entrepreneurs are always on the lookout for opportunities that offer solid.

Read More

Exploring Top Industrial Investment Options: Diverse Opportunities with Jaywant Group's Expertise

When it comes to industrial investments, savvy entrepreneurs are always on the lookout for opportunities that offer solid returns and long-term value. Industrial sheds.

Read More

Unveiling the Future: The Evolution of Industrial Sheds in India with Jaywant Group

The Indian industrial landscape is poised for transformation, and at the heart of this evolution lies the future of industrial sheds. Jaywant Group.

Read More

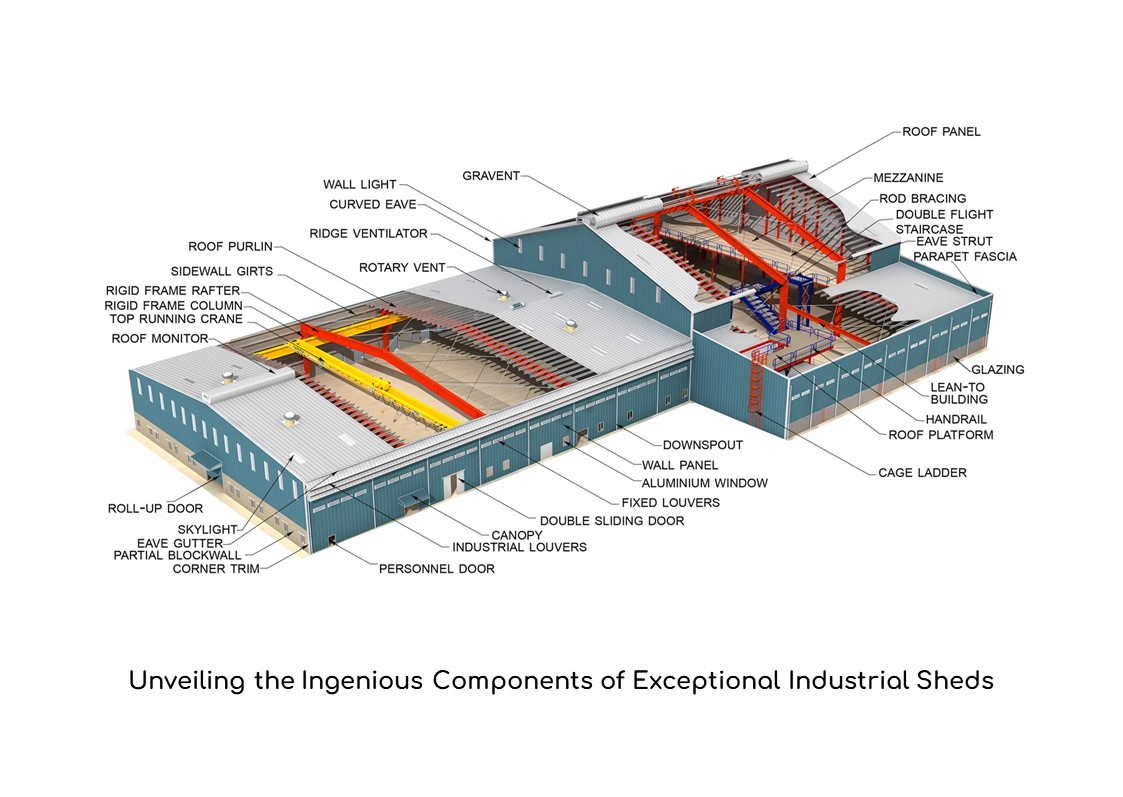

Unveiling the Ingenious Components of Exceptional Industrial Sheds: Jaywant Group's Expertise Shines

Industrial sheds are the backbone of modern business operations, serving as versatile spaces that accommodate manufacturing, warehousing, and various industrial activities.

Read More

5 Tips to maintain Industrial Sheds

Maintaining an industrial shed is crucial for ensuring its longevity, functionality, and safety. Whether you own a manufacturing facility, warehouse, or any other industrial setup, following a structured maintenance

Read More

A Guide with Jaywant Group: Choosing the Perfect Industrial Shed Design

Selecting the right industrial shed design is a critical decision that can impact your business operations' efficiency, functionality, and overall success. With many options available, making an

Read More

Exploring the Farm Land Investment Potential with Jaywant Group

Real estate investment is expanding beyond urban landscapes, and farmland is emerging as an enticing avenue for growth. Jaywant Group, known for its expertise in various real estate sectors, including industrial

Read More

Industrial Plots An Smart Investing Option For Investors.

Investment from the nation has long been well-liked in India. Many citizens of small towns, rural areas, and even farmers themselves own

Read More

How to Select Industrial Plots In India

Industrial plots in India are a matter for the state. There are numerous possibilities for setting up a unit, and investors can communicate with the relevant State Industrial Corporations (IDCs).

Read More

Why to own a farmland In India?

The effects of global warming are being felt over the planet gradually and covertly. To put it mildly, the implications of global warming are negative, and the actions our society takes collectively will determine the future.

Read More

Why Agro Farming Land Is Boon For Investors?

The agricultural system has evolved a number of times over time, but farmers still form the foundation of our society. Of course, this sector has its opportunities.

Read More

The top 4 factors why office space is important!

When your company is ready to move forward and you have amassed a sizable crew, you will need the ideal office space in Pune to centralise everything. A new workplace is something to think about because

Read More

The Growth Of Industrial Warehousing Market In India

Warehousing spaces are in demand post-pandemic, and therefore the industry has emerged as a resilient asset class Market of the industrial warehouse in India has garnered attention from global and domestic institutional

Read More

Why Is It Advantageous to Have an Industrial Sheds

A veritably good volition for holding and storing heavy outfits and ministry is an Artificial chalet. One of the most stylish real estate accessions ever is an artificial chalet.Their return on investment( ROI) is vastly advanced than..

Read More

Launching our New venture Jaywant Events & Entertainment

Jaywant Group has set its foot and gained a very trustworthy name in property development with more than hundreds of satisfied customers. Moving towards soaring success

Read More

Top Benefits Of Industrial Sheds in India

An industrial manufacturing building's aesthetic appeal is one of its main advantages. These buildings are made by Jaywant Group that create them to resemble nicely constructed residences in terms of visual appeal.

Read More

Top Things To Consider Before Buying A Farmhouse Plot

Amidst expansive industrialization and stressful megacity life, numerous people are starting to crave for greenery and a life surrounded by nature. This pull has resulted in numerous successful professionals from different fields to

Read More

Farmhouse Investment In India : The New Trend in Real Estate

As the name suggests, a farmhouse is a real estate property on a piece of agricultural land. Farmhouses are the big trend in real estate as renowned celebrities and business tycoons have been buying them; thus, people want them too

Read More

Is an Industrial Shed Beneficial for My Business?

A practical option for sheltering and storing large machinery is an industrial shed. Your machinery and other valuables are safe and sheltered from the elements thanks to these sheds. Industrial sheds offer

Read More

How To Choose An Industrial Shed?

Industrial sheds come in a variety of shapes, sizes, and uses. Depending on their industry, a lot of firms depend on industrial sheds and couldn't function well without one. They provide numerous advantages to any organization besides their dependability...

Read More

Why Are Industrial Sheds Beneficial?

An industrial shed is a great option for housing and storing large equipment and machinery. An industrial shed is one of the best real estate investments ever. Their return on investment (ROI) is significantly higher than that of traditional warehouses.

Read More

What makes Industrial Sheds a Valuable Business Asset?

One of the most in-demand goods in the modular construction segment is prefabricated industrial shelters. These structures, often known as pre-engineered steel sheds, are extremely adaptable.

Read More

Foreign Investors in the Indian Real Estate Sector

Disinvestment in the Real Estate Sector in India has opened up numerous possibilities for growth and development. Prioritizing and incentivizing foreign investment has praised the country’s Frugality.

Read More

Government Subsidy to start a business in Industrial Sheds

The Government of India established the Loans Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE) to provide collateral-free credit to Indian MSMEs. Existing and new businesses are also eligible for the program.

Read More

JITO connect 2022 : Jaywant Group

Prime Minister Narendra Modi said today that the world looks to India with high expectations and confidence in a variety of areas, including global peace, prosperity, and ways to address global challenges.He was speaking via video conferencing at the inaugural ceremony of JITO Connect, a global summit organised by the Jain

Read More

8 Advantages of Renting an Industrial Sheds

Choosing the right industrial shed or warehouse when starting a business or expanding an existing one is one of the most important factors in a company's success. Another common dilemma is deciding whether to rent or build an industrial Sheds or warehouse.

Read More

Best Industrial Sheds In Pune : Jaywant Group

Consumerism has resulted in rapid industry and product line diversification. The variety and scale of industrial and warehousing setups has grown dramatically, necessitating an ever-increasing amount of space for businesses and industries. While reinforced cement concrete ....

Read More

The Benefits of Buying An N.A Plots In India

With the world adjusting to a post-pandemic world, owning your own home is now a requirement. One can no longer rely on the uncertainties that rented housing presents. According to recent studies, home buyers are interested in investing in residential NA plots...

Read More

INTRODUCING OUR NEW VENTURE “JAYWANT AAROGYAM”

In the field of real estate and land development, Jaywant Group has gained a very trustworthy name. It was set up in the year 2007, as a company with a primary focus on property development. Jaywant Industrial Plotting & Industrial Sheds is now spread across 25 lakh...

Read More

DEMAND FOR INDUSTRIAL SHEDS IN PUNE INCREASED

Today's business scenario in India is more dynamic and practical than ever before. Because of their low cost and ease of access, pre-engineered and prefabricated buildings have grown in popularity since the advent of the internet.

Read More

Real Estate Sector In India: Trends For 2022

Without any doubt the real estate sector emerged as the most desired investment choice in 2021. Reason being the two waves of the COVID-19 pandemic and the consequent lockdowns. As a result, ‘Owning a Home’ became the strong buzzword in every....

Read More

Why Is Real Estate Investment in Pune Beneficial ?

Pune is Maharashtra’s second-largest city and is additionally referred to as the state’s cultural hub. Pune has grown into an enormous metropolitan city that's developing as a bright spot for land investment. Investors consider the town to be one among the foremost feasible....

Read More

Investments In Industrial Warehousing In India

The warehousing sector is witnessing stable demand from e-commerce, 3PL (third-party logistics), cold storehouse, pharma, engineering & manufacturing, and electronics sectors. Regimenting connection entry of big people in the warehousing sector that was otherwise...

Read More